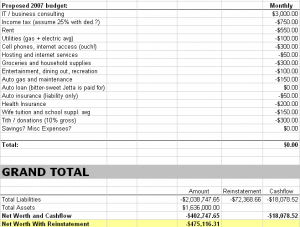

Spreadsheets have always been the go-to method for managing business revenues and expenses. For years, tools like Microsoft Excel, FileMaker Pro and OpenOffice have been coveted financial management tools for small business owners looking to organize their finances.

The reason these tools remain relevant even today is because they make it very simple to add, filter and manipulate the data within them. Even with the advent of cloud based solutions like Google Docs, which allows multiple users to change data within spreadsheets in real time, there are lots of other tricks to make your business expense spreadsheet more functional and easier to manage.

One of the best things about spreadsheets is that almost all of the popular accounting programs allow you to export data into existing documents based on pre-set categories. Most of these accounting programs are integrated with Excel and Google Docs, which means all you have to do is click a button and instant business expense spreadsheets are generated on your computer. Many of them will also allow you to insert images of the documents alongside the cells of data to ensure that the information is correct. Just make sure if you are inserting images that your document does not become too cluttered.

The only problem with a traditional expenses spreadsheet is that it still requires you to manually enter the data you want to track (i.e. vendor, amount, card used, date, line expenses, etc.). While some of the accounting programs will extract the data for you, the best solution is to actually hold onto your receipts and scan them with an OCR system.

There are lots of services and scanners out there that will store your receipts and extract the data from them so you don’t have to. Most of these solutions will also extract information off of bills and invoices, which helps to give you an even more accurate view of your finances. Some services even allow you to generate instant expense reports from your cell phone so you can email them to your employer before you are even back from the business trip!

Here are some other tips for making a good business expense spreadsheet:

- Separate your Personal and Business Expenses: This one may seem obvious, but even one expense in the wrong place could completely throw off your budget tracking. If possible, try to use different cards for your different types of expenses. Sorting by payment method is a great way to separate personal expenses from business ones on a spreadsheet.

- Learn Simple Functions: Tracking your expenses is worthless if you can’t extrapolate the data. Learning how to add, multiply, subtract and divide the different rows and columns is very important for successful expense reporting. A good guide for learning these functions can be found here.

- Graph, Save, Email and Print: Similar to learning the functions, it is also important to learn how to make graphs of the data on your spreadsheets. Graphs are much more helpful for “seeing the big picture” and they are also more meaningful. I should also note that it is crucial for you to save, email and print your spreadsheets every month or even every week. Spreadsheets on programs like Microsoft Excel aren’t saved in the cloud so if your computer dies then you are out of luck.